Real-Life Miners Find Gold with Data Analytics

Part of the fun of watching Discovery Channel’s hit reality TV show “Gold Rush” is guessing which piece of equipment will break next. Will Todd Hoffman lose another excavator in the swamp? Or maybe Parker Schnabel will push his wash plant beyond the breaking point? It’s good stuff, but in the real world of mining, equipment failures are no laughing matter. Now IBM and mining giant Thiess are using big data analytics to minimize their impact.

Mining is a $7-trillion per-year business that involves $5 trillion in equipment, and much of it runs 24/7. The equipment is built to be tough, but the combination of weather, heavy loads, operator abuse, and time itself can wreak havoc on individual components, moving parts, and lubrication fluids.

Mining is a $7-trillion per-year business that involves $5 trillion in equipment, and much of it runs 24/7. The equipment is built to be tough, but the combination of weather, heavy loads, operator abuse, and time itself can wreak havoc on individual components, moving parts, and lubrication fluids.

Unplanned equipment failures can have a cascading impact at big mines. If one of the giant diggers filling trucks in one of Australian mining giant Thiess‘ pit mines is down for a day, the net impact on revenue is $8 million. An individual truck carries a $1.8 million-per-day price tag for downtime. The equipment may look like giant versions of sandbox toys, but these are not to be played around with.

As you would expect, mining companies and equipment operators have devised policies, processes, and procedures to manage preventive maintenance and minimize the financial impact that broken excavators, trucks, conveyors, and other gear can have on a big mining operation. They use some analytic capabilities, but they are fairly primitive by the standards of other industries. Now IBM and Thiess are looking to change that with big data.

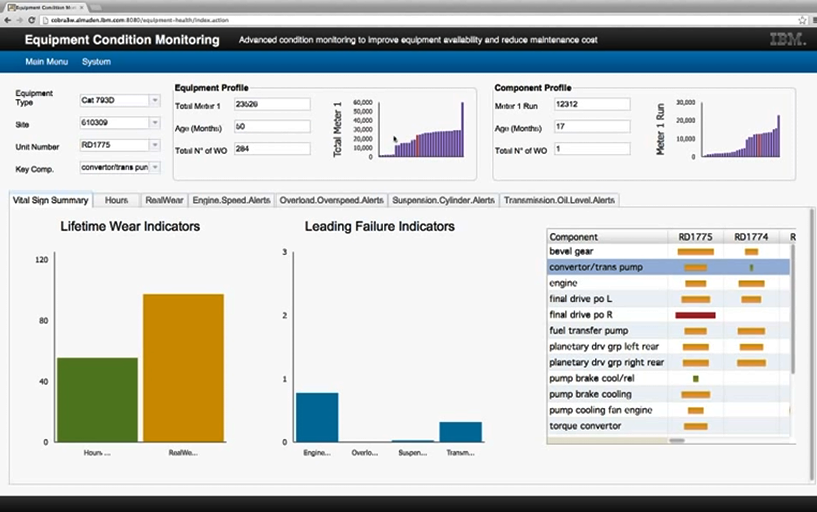

The predictive analytics application that IBM built for Thiess uses data collected from Thiess’ equipment. On each truck, hundreds of sensors continuously streams data back to a database, providing rich, real-time data across all sorts of parameters, including load weights, fuel consumption, terrain, and lubrication oil properties.

This data is gathered, correlated, and compared to a database containing five to 10 year’s worth of equivalent equipment data. Whereas most mine operators rely on the metric of “predicted wear,” IBM’s big data kit is able to devise a metric that’s closer to actual wear, thanks to the capability to monitor 200 variables for each component.

It’s not always possible to peer inside of a transmission or a transfer pump, especially when the $20-million piece of equipment is supposed to be working for its owner. The big get for Thiess lies in the ways that IBM can take individual events (such as overloading, abusive driving, and bad weather), apply them to the overall lifetime wear-and-tear model, and then generate repair alerts for individual components.

IBM is basically mining the sensor data for wear patterns for each individual component, and throwing out warnings any time the near-term risk for, say, a fuel pump failure exceeds a threshold that a mine operator is comfortable with. Thiess, thus armed with better information about the likelihood of individual component failures, can be ready with backup parts and contingency plans. IBM says this approach can add $3 billion to the bottom line of a $30 billion mining business.

It’s not only about being smart with big data analytics, but integrating it into current processes, says Michael Wright, executive general manager of Australian mining for Thiess. “Working with IBM to build a platform that feeds the models with the data we collect and then presents decision support information to our team in the field will allow us increase machine reliability, lower energy costs, and emissions, and improve the overall efficiency and effectiveness of our business,” Wright says in a press release.

Related Items:

SAS and IBM King of Analytics Hill, But for How Long?

Mining Twitter Data for Disease Risk

Shell Drills into Big Data Analytics