Analytics Investment Up, Insights Down, Survey Finds

Despite relatively heavy investment in data analytics, a new survey finds that most enterprises have little to show in the way of business intelligence that could be leveraged to compete in the marketplace.

That’s the conclusion of a new data analytics survey that also found that 65 percent of the companies surveyed have increased spending on analytic services and technologies in 2014. The industry survey was released on June 16 by the data management and analytics company Lavastorm Analytics.

Lavastorm said 495 senior-level executives as well as analysts and data scientists responded to its survey. The study found growing investments in data analytics but, so far, little to show in terms of turning data insights into usable business intelligence.

“Businesses are more committed to implementing big data analytics than ever before, but, far too many are still struggling with how to maximize the benefit,” Lavastorm CEO Drew Rockwell said in a statement releasing the survey.

The good news is that business investment in data analytics is growing, with 64.4 percent of respondents saying they are increasing their investments in analytics. More than 20 percent said spending was up “significantly.”

The downside is that a mere 12.6 percent of respondents said they actually launched big data projects. The result, the study warned, is the emergence of big data “haves” and “have nots” that is being exacerbated by the lack of analytic professionals.

The shortage is leading to what the survey’s authors referred to as “inefficient analytic supply chains” as businesses scramble to find qualified analysts to both collect and glean insights from data. For now, “The multiple handoffs and specialists involved in the analytic supply chain slows progress,” the survey warned.

For example, data scientists working in research and development or in IT departments tend to be isolated from decision makers. Business and data analysts “are in the dark when it came to big data technologies and the work that their company was doing to leverage those sources,” the survey found.

“The best business results will only be obtained, however, when the business is heavily involved in the planning and analysis.”

Another concern is data quality. Forty-eight percent of respondents told Lavastorm that they have committed more resources to focus on data quality, a 27 percent increase over last year, when the data analytics survey debuted.

“This is why 35 percent of survey respondents who are increasing analytic investments in 2014 said their company is also investing in data management,” including integration and enrichment, the survey noted.

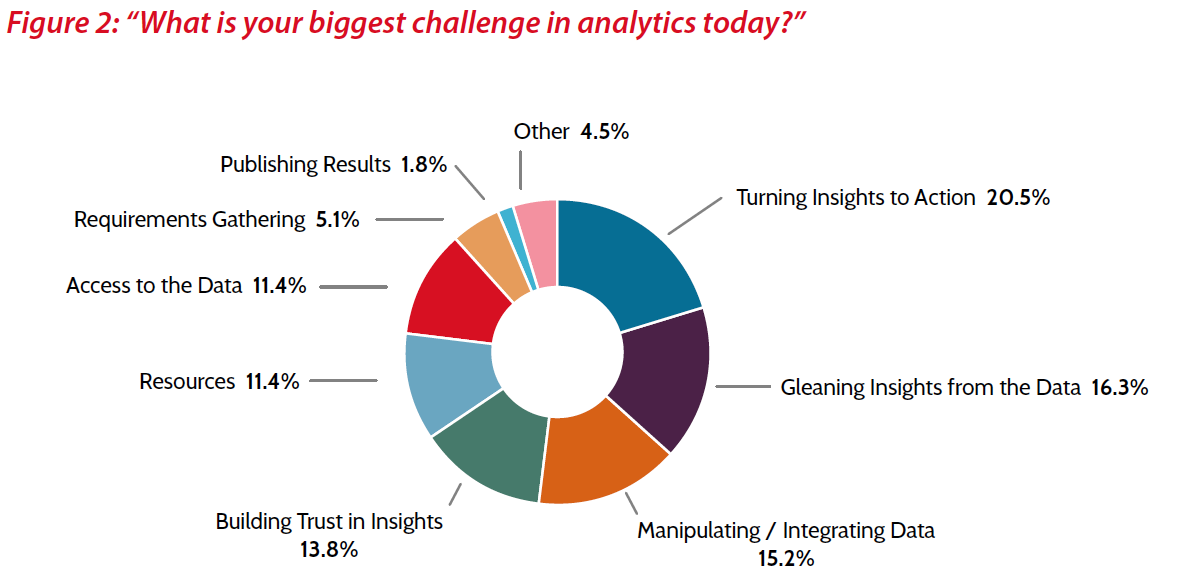

Asked about their biggest challenges in analytics, respondents most often cited “turning insights into action” (20.5 percent). Other challenges included “gleaning insights from the data” (16.3 percent) and “m anipulating/integrating data (15.2 percent).

anipulating/integrating data (15.2 percent).

According to the survey, respondents each use more than four analytics tools. Most often used by business and data analysts are general-purpose tools, including Microsoft Excel, SQL and Microsoft Access. Which points out another gap in current data analytics: These general-purpose tools are not designed for current complex data environments.

Hence, a mismatch may be emerging between businesses’ expectations and the fruits of big data analysis.

Related Items:

Employers Paying a Premium for Big Data Skills

Survey Finds Disconnect Between Big Data and Decision-Making