Scoring Hidden Insights from Location Analytics

Amid the tsunami of big data that’s being generated every day, geo-location data often gets lost in the wash. But to a certain class of big data practitioner, where you go in a city is almost as important as what you do. And thanks to the ubiquity of smartphones these days, data about your location is constantly trickling up to the grid, where smart businessmen can take advantage of it.

The biggest consumers of location analytics these days are retailers. “They live and die by foot traffic in a lot of cases,” says Mossab Basir, CEO of a Toronto-based location analytics firm called Via Informatics. “Understanding the traffic around their location, as well as potential locations, is critical in terms of planning.”

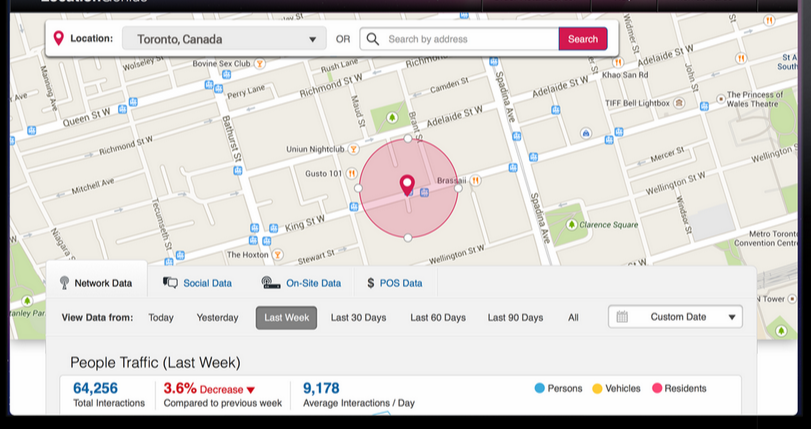

Via Informatics is one of a growing number of companies playing in the geo-location space. Its core offering, called LocationGenius, lets retailers see, at an aggregate level, who is moving around in cities and where are they going, so that they can make more effectively market products and services to consumers, and also identify the prime locations for new stores.

Previously, these types of location studies would require long, drawn-out investigations, but thanks to the always-on feed of big data streaming in from cell phones and social networks, Via Informatics is supplying the location intelligence as a service that companies can tap into whenever they want.

“We are disrupting the traditional method of collecting data of how people use streets and move throughout cities, in terms of counting [people] but also in terms of profiling traffic in and around a location,” Basir tells Datanami. “We have a hypothesis that scoring is the most compelling and powerful thing you can do for location data.”

It’s All About the Data

On a daily basis, Location Genius pulls 800 million rows of location data into an analytics database developed by SpaceCurve, which was specifically designed for storing and analyzing geolocation data. The company had used an Oracle database, but found SpaceCurve’s database–which analyst Robin Bloor dubbed “the first of a new generation, a super-scale data platform with real-time data ingest”–scaled more effectively for this particular form of data.

Via Informatics crowdsources anonymized data from three locations: aggregated and anonymized log data sold by cell phone companies; social network firehose data from Facebook and Instagram; and location data obtained from the Wi-Fi and Bluetooth radios in consumer’s smartphone, via its own sensors and those run by third parties.

“We use bulk cell data at a national scale in the regions our software is deployed,” Basir says. “And the social network data is from volunteer social network interactions. If you haven’t disabled the geo-stamping of your social activity, if you haven’t gone private, then we use that at an aggregate level.”

All this location- and time-stamped data is loaded into the SpaceCurve database, overlayed on maps, and then presented to customers for queries. There are two main ways that customers interact with LocationGenius. The first involves looking at a large area, and asking a question like “Where is the best place to open a gluten free café in Toronto?”

For that type of ad hoc query, Via Informatics would pull foot traffic from all locations in the city, and perhaps cross-reference it with demographic information, such as age and income levels. “We would say ‘Are you looking for a place that gets at least 10,000 or 100,000 walk-by traffic a week?” Basir says. “We overlay all of those input, and deliver the top 25 hotspots that meet that criteria.”

The second way customers interact with LocationGenius is by focusing on a specific point of interest (POI). For example, the owners of a small coffee shop could use the software to get a better idea of who is walking by their shop. Perhaps the data shows them that there is a pattern of foot traffic before 7 a.m., which may tell them their business hours are not optimized.

The combination of descriptive and prescriptive elements gives LocationGenius the capability to score the real world depending on the customer’s needs. “What happens is the score changes based on the vertical,” he says. “If you’re a city planner, you’re looking to score locations based on a certain criteria, such as traffic flow across the city, whereas if you’re retailer, you’re going to score based on the best place to open a coffee shop. We want to score the physical world in a way that each person looking at it.”

Location, Location, Location

Retailers are Via Informatics’ biggest customer segment, but in its early days, the company catered to the needs of a different group for whom location is also a pretty big deal.

“We started off working with shopping mall companies that already spend a whopping amount of money with consulting firms to do one-off studies,” Basir says. “We kind of disrupted this space by saying this shouldn’t be a consulting study every time you want to pull location data. You should just be able to do via a web service or software, on demand, so that’s exactly what LocationGenius does.”

In the same way that Internet giants like Google and Yahoo invented big data to gather, store, and process huge amounts of activity data to improve their online services and attract more customers to their websites, bricks and mortar retailers are tapping into location data to find out more about the potential customers that are walking by their storefronts every day.

Thanks to the ubiquity of smartphones, consumers can be in two different worlds–the online world and the real world–at the same time. And thanks to products like Location Genius and the underlying Space Curve database, organizations now have the tools to break down the barriers and view what people are doing in both realms.

“We’ve been doing this in the virtual world for 20 years, building up the ability to do really impactful, efficient marketing on the Web,” SpaceCurve CEO Dane Coyer told Datanami earlier this year. “But not so much in the physical world. One of the use cases is bringing that capability out into the physical world.”

The fast pace of business today will increasingly drive companies–and in particular retailers targeting consumers—to keep up with what’s going on in the physical world, Basir says.

“There’s a lot of users who, for budgetary reasons, only do this type of location analysis once a year or every three months,” he says. “But if you look at retailers who are running campaign…they want all the data they can get, in a fluid format, about how they’re actually performing.”

Related Items:

5 Ways Big Geospatial Data Is Driving Analytics In the Real World

Building a Better (Google) Earth

It’s Sink or Swim in the IoT’s Ocean of Bigger Data