How Big Data Can Empower B2B Sales

(pixfly/Shutterstock.com)

As consumers, we’ve grown accustomed to having Big Data look over us. We’re no longer surprised when Amazon recommends a perfect of headphones for a 14 year-old girl, or when Target reminds us it’s time to buy laundry detergent. But big data is also impacting how businesses go about selling products and services to other businesses. Here are some examples.

One company bringing analytics to B2B sales is Reltio. The Redwood City, California-based company develops a big data app that helps sales and marketing teams in pharmaceuticals, life sciences, and other industries pinpoint possible customers.

As Reltio CMO Ramon Chen explains, the software as a service (SaaS) app gives clients a 360-degree view of their prospects, without burdening them with the massive data collection, normalization, and analysis project that such a capability would entail if clients built their own system.

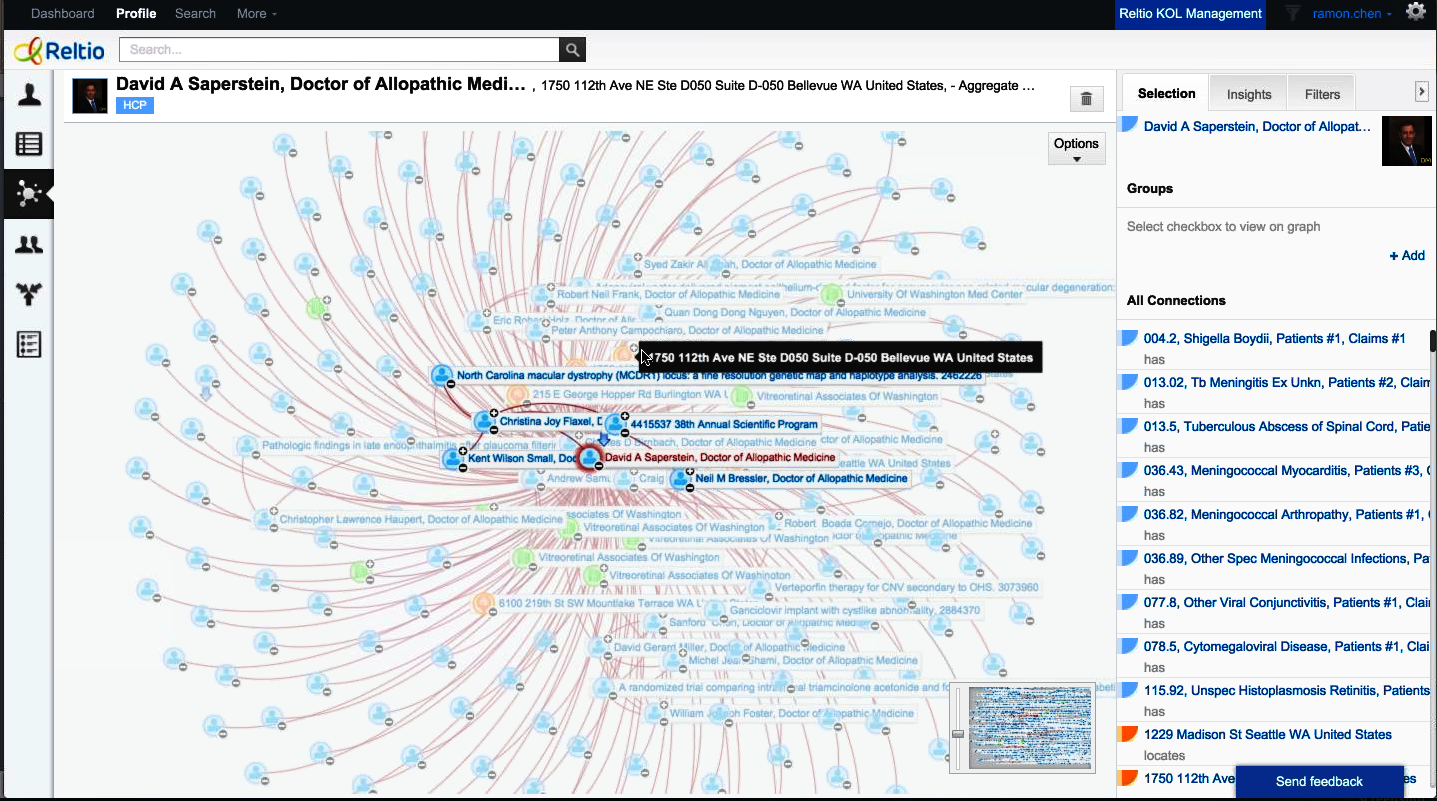

“If I’m in pharmaceutical sales, and I want to find healthcare experts for a particular set of drugs within a particular geographic area, I have that at my fingertips now,” he tells Datanami. “We draw data in, reconcile it, and make sure it correlates to the right person. As we’re pulling data in, we’re building a massive graph, so relationships are spawning across products, people, objects, and publications.”

“I put [the prospect] at center of universe,” Chen continues. “We’re getting to that often cited, but never delivered, 360-degree-view of a person.”

The Reltio system–which runs on big data technology like Apache Cassandra, Apache Spark, and ElasticSearch under the covers–makes it easy for clients to combine data from their own databases with third-party data, such as public LinkedIn (NASDAQ: LNKD) and Facebook (NASDAQ: FB) profiles, or even proprietary data from services like Dun & Bradstreet. But Reltio is no data broker. Instead, its secret sauce lies in how it enables clients to create better institutional knowledge by intelligently sourcing, cleaning, combining, and analyzing disparate data sources within the construct of individual industries.

While Reltio leverages Spark-based machine learning models to provide advanced predictive analytics for relevant insights and recommended actions, reliable data must first be formed through a data cleansing and normalization process. Reltio automates this capability, as well as providing an easy way for humans to contribute their knowledge and judgement to data that needs closer inspection. The company’s user interface makes it easy for users to explore, filter, and refine their data. When new data sources are added to a corpus, the software maintains separate lineages so it can be rolled back if needed.

Reltio’s browser-based interface gives B2B salesmen a leg up on using big data to spot prospcts

The end goal is to provide a data-driven application that immediately responds to the inputs of a user and grows with her experiences at a company, like an analytically focused LinkedIn. The technology is industry agnostic, but the two-year-old company has created several apps for specific industries, like healthcare and life sciences. It also has customers in media, oil and gas, and other industries.

The company has attracted attention from analysts, such as Bloor Research: “Reltio is, in our opinion, a significant step — probably several steps — ahead of the market,” the analyst group said. “[Reltio] has re-imagined data management: extending it, making it simpler and evolving it so that it isn’t just a part of your data governance story but also something that drives better business decisions.”

Another company tackling the potential of predictive analytics in the B2B market is Leadspace. Like Reltio, the San Francisco-based company lets customers combine data from their own private data stores with third-party data and the open Web, in an effort to paint a more accurate picture of prospects.

“We combine not only predictive analytics but on demand data,” says Dave Thomas, senior director of inbound marketing. “We’re sending out calls in real time to pull data together from a variety of sources–private databases, and the open and social Web.”

But Leadspace’s real forte is detecting “buy” signals that may be buried in a lot of noise. “The predictive aspect analyzes not just firmographics data but intent data–this person is ready to buy now,” Thomas says. “It brings all that data together in Salesforce (NYSE: CRM), Marketo (NASDAQ: MKTO), or Eloqua (NASDAQ: ELOQ), and presents it to the marketer so it can be seamlessly pushed into a campaign.”

Leadspace can deduce intent in part by combining IP addresses with search terms individuals use (JMiks/Shutterstock.com)

Detecting that buy signal isn’t necessarily easy. But when done right, it can give Leadspace customers a significant competitive advantage. The company claims to boost conversion rates up to 40 percent in some of its clients, and it streamlines the inbound routing of leads as well. “They don’t have to waste time. They can just call the right prospects immediately,” Thomas says.

Exactly how the company detects the buy signal is a bit of a mystery. Getting exclusive access to detailed Web traffic data is a big part of the equation, and having the right algorithm on hand to extract the signal is important too. Suffice it to say, the needle starts to move when a combination of events–such as specific search terms entered from a specific IP address—are detected.

Deducing intent from data is a new twist on an age-old challenge for sales and marketing teams. “Behavior scoring has been around for a long time. Have they downloaded a paper?” Thomas says. “But behavior is offsite too. Are they searching for terms related to your industry? Are they interacting with ads?”

Most of Leadspace’s customers are in the high tech field, but it also has clients in business services, healthcare, financial services, and education. Many companies have digital footprints these days, and they’re potential prospects for the Leadspace service.

The B2B market differs from the direct retail market in important ways. But as Reltio and Leadspace show, companies that sell to other businesses can also leverage big data and analytics for a competitive advantage.

Related Items:

Why Spark Is Proving So Valuable for Data Science in the Enterprise

Airlines Embracing Analytics to Stave Off Disruption

How Retailers Are Benefiting from Prescriptive Analytics