Forrester’s Crowded NoSQL Wave Shows Abundant Options

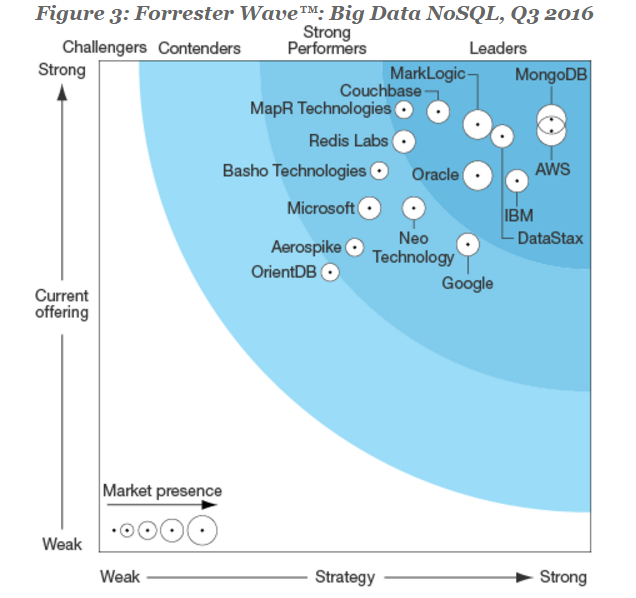

The increasingly crowded NoSQL database market promises to give customers lots of storage options for next-gen and big data applications. That’s one of the takeaways from the recent Forrester Wave for Big Data NoSQL solutions, which gave NoSQL database giant MongoDB top honors in a big pack.

When Forrester analyzed the NoSQL market two years ago, it offered two separate waves, including one for document databases, led by MongoDB and MarkLogic, and another for key-value databases, led by MapR, Oracle, AWS, Aerospike, and Datastax. All told, fewer than 10 vendors made the cut.

This year, Forrester decided to combine the various NoSQL databases types into a single report, including not just document and key-value stores but graph databases too. The resulting report includes no fewer than 15 NoSQL offerings for use on-premise and in the cloud.

Forrester put nine NoSQL products in a crowded Leaders sector. Analyst Noel Yuhanna put nearly all of the above-mentioned vendors in the leader’s quadrant, with the exception of Aerospike (which was put in a lower category) and with the addition of Redis Labs, Couchbase, and IBM (NYSE: IBM), which bought Cloudant.

In the Strong Performers sector, we see names like the in-memory Aerospike database, Redis’ key-value store, graph database maker Neo Technology, Riak developer Basho Technologies, and software giants Google (NASDAQ: GOOG) and Microsoft (NASDAQ: MSFT). OrientDB, a developer of graph database, was listed in the Contenders section.

Yuhanna says MongoDB deserves top honors. “With more than 2,000 paying customers, including more than half of the Fortune 100 companies, it’s popular among developers because it’s easy to use, scales to meet the most demanding applications, and offers the most comprehensive ecosystem of tools and partners,” he writes in the Wave.

DataStax, which is the company behind the open source Apache Cassandra database, received high marks from Forrester for its “global distributed architecture,” a reference to the product’s market-leading capability to scale widely. MarkLogic was hailed as “one of the most mature NoSQL databases,” while the analyst group called Couchbase’s document database a “viable” option for companies that need performance, scale, and automation, along with multi-model deployment capabilities.

Oracle’s database is suitable for existing Oracle clients, the analyst group says, while MapR-DB stands out thanks to its partition in its owners “converged platform” that combines Hadoop-based analytics, real-time stream processing, and NoSQL capabilities on the same physical cluster. Redis Labs got on the leader’s board thanks to its quick in-memory performance, flexible data model, high availability, and ease of deployment.

Among cloud-based offerings, Amazon’s DynamoDB took top honors. Forrester gave the offering high marks for its use of SSDs, and also appreciated features like automatic sharing, easy scalability, and integration with other AWS products like Elastic MapReduce (EMR). IBM’s Cloudant, which is a hosted version of the open source CouchDB project, got high marks for IBM’s ability to execute, professional services, and support. Google missed the cut-off for the Leader sector, but still managed to make the Strong Performers sector on the back of good performance, scalability, and being flexible to developers. Microsoft also made the cut with its hosted DocumentDB; Forrester appreciated its scalability and reliability, and expects good things to come from DocumentDB in the future.

Neo Technology took top honors among graph databases, thanks to a 200-strong customer base and capability to support business critical applications with its fully ACID compliant database that supports transactional and analytical workloads. Its younger competitor, OrientDB, got high marks for its multi-model engine, ease of use, performance, and small footprint. Aerospike also collected kudos for its unique distributed architecture that utilizes both DRAM and Flash storage.

NoSQL databases are no longer viewed as odd ducks in the database realm. Instead, they’ve become necessary components for next-gen applications, and organizations of all shapes and sizes are adopting them, according to Yuhanna.

According to a Forster survey, more than 40% of organizations have implemented, are implementing, or are upgrading an existing NoSQL database. Only 13% say they have no interest in NoSQL databases, while 20% say they have plans to impomement them within the next 12 months.

While NoSQL technologies get lots of attention, they still make up just a fraction of the total database market. According to IDC, in 2014 Hadoop and NoSQL accounted for about 3 % of a total database market worth about $37.7 billion. Relational technology is expected to account for the lion’s share of database spending for the foreseeable future.

You can view the 2016 Forrester Wave on Big Data NoSQL solutions here.

Related Items:

Three NoSQL Databases You’ve Never Heard Of

Forrester Ranks the NoSQL Database Vendors

How NoSQL Drives Analytic Agility at Nielsen