Machine Learning’s Adoption Gap: Assessing the Consequences

(Jirsak/Shutterstock)

Despite its position as a key element driving big data analytics and artificial intelligence, machine learning is scarcely being adopted by companies at large. That’s the conclusion of a new report on digital transformation conducted by SAP. But despite the slow start, there is a real potential to catch up.

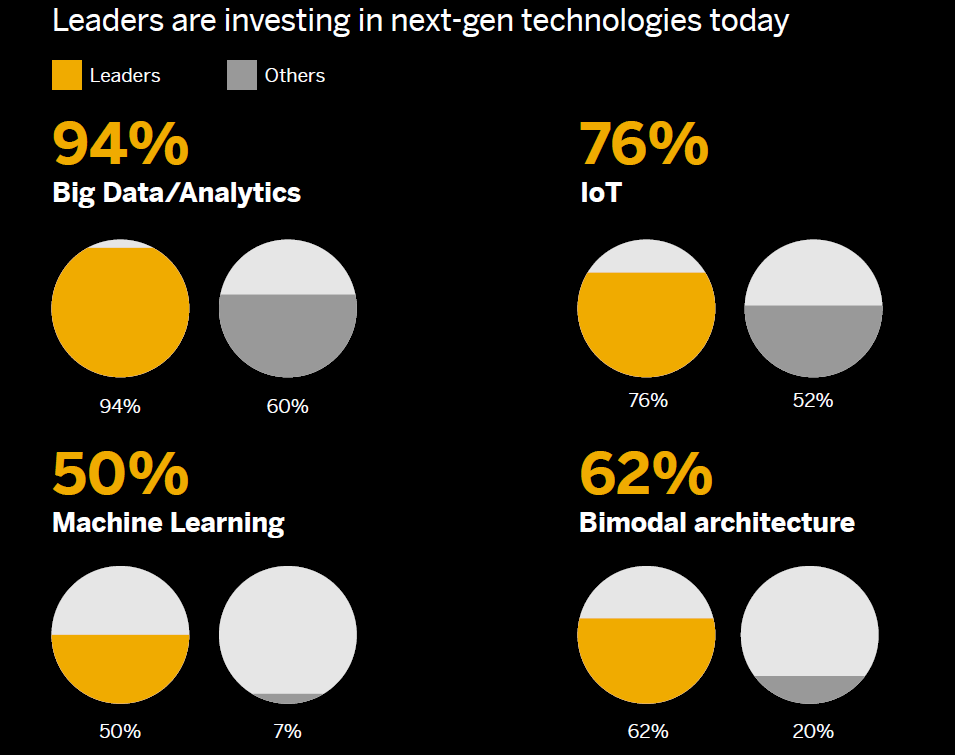

The German software giant found that only 7% of the 3,100 companies that participated in a survey are investing in machine learning technology. By comparison, 50% of the companies that the SAP Center for Business Insight defined as “leaders” have made machine learning investments.

The survey, which was conducted with Oxford Economics, found similar differences in the adoption of “big data/analytics” (94% for leaders, 60% for the population as a whole) and IoT (76% adoption among leaders, compared to 52% adoption by the rest of the pack).

Together, these technologies – and you can throw artificial intelligence (AI) and cloud computing into the mix for good measure — are some of the primary breakthroughs that experts expect to disrupt markets, displace entrenched commercial interests, and spur the creation of new products and services over the coming decades.

However, the gap between the leaders and the rest of the pack is a stark reminder of how new these emerging technologies really are, how much investment is required to get projects going, and the difficulty that many experience in getting get tangible results out of them.

Tesla may have an “insurmountable lead” in road condition data through widespread data gathering and machine learning, SAP’s Elliott says (Taina Sohlman/Shutterstock)

Timo Elliott, an innovation evangelist for SAP, says there are potentially enormous consequences to the machine learning gap. One of them is the inability to capitalize on the network effect that occurs when the use of machine learning helps to improve products and services automatically over time as more people use them.

“For example, Tesla cars equipped with Autopilot gather information on every journey and share it with the other cars – constantly updating and improving the driving experience,” Elliott tells Datanami. “That data doesn’t just improve Tesla’s current products; it will also provide the foundation for new business opportunities in the future.”

Eventually, every product and service will have a learning component, Elliott says. The benefits of the “virtuous circle of growth” – where feedback leads to a better customer experience, which leads to more product sales, which in return generates more and better data that further improves the product — is just too great to pass up.

But in the meantime, there is confusion about how best to apply machine learning in the enterprise. “A lot of the public awareness [around machine learning] has been focused on consumer uses such as image tagging of Google photos, or complex ‘cognitive’ uses,” Elliott says. “But it’s the stuff that might actually be considered boring that is actually the most exciting.”

For example, chemicals giant BASF used machine learning to improve their invoice payments processes. “While it isn’t that glamorous,” he says, “the result is big and it directly benefits the bottom line.”

AI’s 1% Problem

The difficulty of applying machine learning in real-world companies (i.e. not the Googles or Teslas of the world) is something that Ali Ghodsi, the CEO and co-founder of Databricks, has also identified.

Most companies report investing in big data analytics, but few are doing machine learning (Source: SAP Center for Business Insight)

“They’re all excited about AI and big data,” Ghodsi told Datanami earlier this year. “But what we realized was there’s basically a big gap between what you, the media, is writing about and what’s happening in reality.”

Outside of the largest digital firms and vertical innovators like Tesla or Uber, very few companies are having sustained success with artificial intelligence and machine learning, he says.

“There are only 1% that are succeeding in AI,” says Ghodsi, who’s also a UC Berkeley professor and RISELab advisor. “In fact, it’s even less than 1%. The rest of the 99% are sort of left behind and they’re sort of struggling to get all this big data technology.”

The question becomes, then, is how the industry can help a bigger swath of companies benefit from AI and machine learning. One of the most obvious solutions is that the software – including the data science and the data management tools — needs to become simpler and easier to use. The stunting complexity around big data management platforms like Hadoop has been well documented in these pages and elsewhere.

In addition to simpler software, Ghodsi advocates that the cloud can provide more simplicity at the infrastructure level. The lack of highly trained data scientists and data engineers is also one of the most commonly cited reasons for the inability for organizations to take advantage of the power of machine learning.

Long-Term Prospects

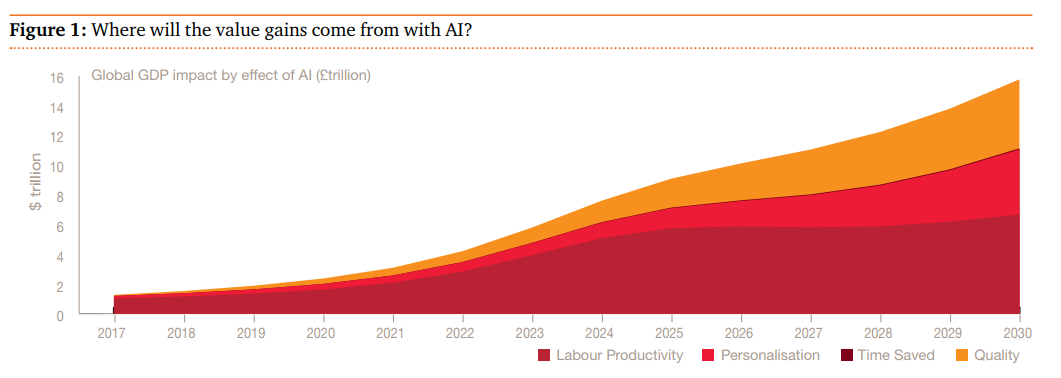

Despite the reports of a usage gap, the long-term prospects for AI and machine learning remains bright. A recent PricewaterhouseCoopers study pegged AI’s potential impact on the global economy to be on the order of $15.7 trillion by 2030. The biggest chunk of the economic gains (about $9.1 trillion) will come from a stimulation of consumer demand through better and more personalized products, while increased employee productivity will drive $6.6 trillion.

AI’s long-term impact on the global economy is projected to be massive (Source: PwC)

That’s a lot of money that’s potential up for grabs for those organizations that can harness the power of AI and machine learning. PwC warns “Businesses that fail to adapt and adopt could quickly find themselves undercut on turnaround times as well as costs. They stand to lose a significant amount of their market share as a result.”

The upside is that there’s plenty of room for growth in the use of machine learning. That’s particularly among small and midsize companies, but it’s also true among larger firms that have not successfully leveraged digital transformation.

What’s uncertain at this point is whether the most successful users of machine learning and AI will leverage the network effect to expand their lead, or whether the lead is already, or will become, insurmountable.

The SAP report seems to indicate that the gap could get bigger before it gets smaller. “The top 100 companies,” the SAP report finds, “are 2.5 to 4 times more likely to report value from next-generation technologies, affecting every part of the enterprise, from customers and partners to brand value, employee engagement, and revenue growth.”

Companies that want to catch up must “pull an Elon Musk” and change the terms of the conversation, SAP says. “Stop doing piecemeal IT projects. Stop treating IT as the enabler of business rather than a strategic partner. Stop handing off responsibility for digital transformation to a siloed group and then complaining when it doesn’t deliver any significant changes.”

SAP’s Elliott is bullish that AI can be an equalizer — particularly thanks to the opportunity to automate the work that’s today done by the class of employees known as knowledge workers.

“It’s hard to think of a business process that doesn’t include some form of complex but repetitive decision-making,” he says. “The good news is that in these cases, it’s relatively easy to catch up with the leaders: the power of machine learning is being seamlessly embedded into the applications that companies already use.”

Related Items:

How AI Fares in Gartner’s Latest Hype Cycle

Taking the Data Scientist Out of Data Science