Inside One VC Firm’s Hands-On Approach to AI

(Lightspring/Shutterstock)

There’s no shortage of tech entrepreneurs taking venture capital money to turn their artificial intelligence ideas into AI reality. These startups typically fill up at the VC spigot and go back to their offices to build product, with check-ins from the VC firm along the way. That’s pretty much the complete opposite of the approach taken by Analytic Ventures.

Analytic Ventures may look like your typical VC firm from the outside, but it’s anything but on the inside. About a year and a half ago, the San Diego-based company created Analytic Ventures Fund 1, which sought cash from investors for the purpose of investing in startups that aimed to use AI tech to build products and services.

But Analytic Ventures is anything but your run-of-the-mill VC firm. That’s because, in addition to being the middleman to fund AI startups, the company also manages and operates the startups that it’s investing in.

Except for the outside funding, the firm handles everything in-house: From coming up with the germ of an idea and validating it, to building an AI product and launching it into the marketplace. “Instead of being a typical early stage venture fund, we actually are an organization that’s starting all of our ventures from scratch,” says Andreas Roell, one of the firm’s three managing partners.

Venture Studio

Analytics Ventures follows what Roell calls the “venture studio model.”

“We spend a significant amount of investment in a studio model that is literally our own, that is residing in our offices,” Roell tells Datanami. “It’s being deployed across all of our ventures.”

Analytic Ventures currently has nine investments, or ventures, that it’s working on from its office building in Sorrento Valley, an area of San Diego that’s best known for its innovation in biotech and mobile computing. Over the course of its fund, it’s founded 14 ventures and created 1,600 jobs, it claims.

Some of the employees working on the ventures work for the startups themselves, while others work for Analytic Ventures. The CEOs, product managers, and marketing teams are typically dedicated to specific ventures, while human assets in general-purpose areas like finance, legal, and HR work across ventures.

The company has 15 data scientist on the payroll who help build the machine learning and AI technology. Roell is particularly proud of the AI laboratory, which generates and refines the technology at the heart of the company’s investments.

This general approach to sharing resources is not dissimilar from other incubators, such as the famous Y Combinator lab in Mountain View, California that has spun off numerous successful startups in big data and AI. But there are important differences with Analytic Ventures’ approach, Roell says.

“A typical incubator …has a very specific and time-based program, nine weeks or six months,” he says. “It’s very repeatable. Every single step, they do it exactly the same. Once you literally graduate, you’re on your own.

“We take a different approach,” he continues. “First of all, it’s a very hands-on approach. And secondarily we believe that a significant portion of value is generated by understanding and accepting and operating around the unique dynamics of each venture.”

Time-Series

There is also common underlying technology to each of Analytic Ventures’ offerings: multi-channel time-series analysis.

The company has developed what it considers to be a superior set of deep learning algorithms and models for finding patterns and anomalies across multiple time-series data streams, and each of its ventures provide some unique industrial application of that underlying technology.

“Our AI lab [is composed of] brilliant people that we’ve been able to gather from around the world who have built proprietary technology and algorithms in the area of time-series data that we can deploy in a similar way or tailored way across all of those ventures,” Roell says.

The ventures are all fairly young, so there’s not a lot of data to say how successful the approach will be. According to Roell, the firm is adamant about creating products and services that are viable in the marketplace.

“We have a mindset of a traditional VC, so that means we’re not doing this just for philanthropic and joyful benefits,” says Roell, who played professional soccer in Germany in the 1990s before kicking off his tech career in the first dot-com boom with a Web portal for professional athletes called PrimePlayer. “That means we need to seek some type of liquidity event. That could be an acquisition or it could be a public offering.”

AI Talent

In the meantime, Analytic Ventures seeks to build revenue-generating companies that can stand on their own. Roell is adamant that Analytic Ventures is not focused on giving data scientists a playroom, or “unicorn building” as he puts it. “We’re in the business of building real-world application that have proven themselves to customers willing to pay money,” he says.

With that said, recruiting data scientists is incredibly difficult today, especially when Web giants like Google and Facebook can offer high six-figure and even seven-figure salaries to attract the 10,000 or so data scientists that The New York Times says have the skills necessary to build AI products.

To get around this roadblock, Roell says Analytic Ventures looks for individuals who have an entrepreneurial spirit and a background in hard sciences, such as physics.

“We’re able to attract physicists and augment them to become AI experts. We do the same thing with biologists and people with neuroscience backgrounds,” he says. “We’re able to train and augment individuals from other areas that are not typically being sought after in order to build out our talent pool to work with our fusion of AI approaches to build the techniques that we would like to see.”

Analytic Ventures also recruits from the University of California, San Diego, which has a large data science program for both graduates and undergraduates. In fact, UCSD graduates more data scientists than UC Berkeley and Stanford University, Roell says.

But the company must cast a wide net to find the talent it needs in San Diego, which has a reputation for a laid-back coastal lifestyle and affordable housing – at least compared to the sky-high prices in the Bay Area. However, the San Diego lifestyle doesn’t really factor into the equation for most data science recruits.

“It’s just a nice little gift on top of what we’re buying in on,” he says. “We’re proud of how we’re able to bring this type of talent into a comity that maybe from a VC capital standpoint is tier two or tier three.”

Like the AI companies that it’s starting, Analytic Ventures itself is quite young. The company’s unique business model is still playing itself out, and at this point there is still more promise than proven success. But that isn’t going to stop the company from putting its chips down and seeing where the AI dice land.

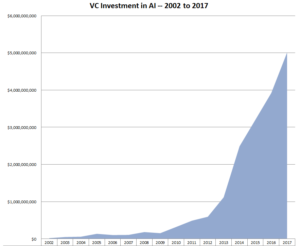

“AI is still in its absolute infancy,” Roell says. “When you think about the breadth and ability to integrate artificial intelligence into day-to-day business and operates and experiences, we have barley touched chapter one. The majority of artificial intelligence investments is happening in early stage, seed stage right now. That means the market in general knows that a lot of innovations and new ventures need to be created in order to harness all the opportunities that reside within artificial intelligence.”

Related Items:

VC Firms Invest Heavily in AI, Pushing Hype Bubble Bigger

AI Investment Up, ROI Remains Iffy

Editor’s note: This article has been corrected. Analytic Ventures has not disclosed the amount of money it’s raised. The $124-million figure referenced in fact refers to the total that company founders have raised across all of their activities. Datanami regrets the error.