SAS Charts AI Future, But Doesn’t Forget Analytics Past

(Peshkova/Shutterstock)

What happens when you put a neural network in charge of a rules-based marketing automation solution? Would the AI emerge victorious, or does the human driver still have a thing or two to show the talented mimicker? It’s an interesting question, to be sure, but more importantly, and it’s an experiment that the folks at SAS – which still uses rules-based approaches in some of its analytics offerings — actually ran, and the results might surprise you.

“It beat our system,” SAS Executive Vice President Oliver Schabenberger said during the SAS Analytics Experience conference held last week in San Diego, California. “No competition.”

The result forced Schabenberger, who also holds the title of CTO and COO, to inquire about the cause. “Why is it the AI system works better than what our best minds can put together?” he said.

SAS came up with two main conclusions. First, AI excels in complex environments. Marketing campaigns managed by humans can have at most 100 customer segments, whereas AI can manage thousands of segments, while adhering to the logic expressed in the business rules.

“That gives you a much more granular view without doing anything,” Schabenberger said. “That was really eye-opening to me.”

Secondly, the AI is faster at the repetitious actions of trying different permutations, of “playing” with the variables to figure out better ways to turn the knobs to get a desirable business outcome. In other words, “they figure out better rules,” Schabenberger said.

This story says a lot about where SAS is today, and where it hopes to go in a future that will increasingly feature AI technology.

AI’s Place at SAS

How quickly SAS adopts AI could be viewed as a barometer of sorts for AI’s overall readiness in the enterprise. That’s because the 43-year-old company has 3.24 billion reasons not to shake the boat too much by relying on AI too much.

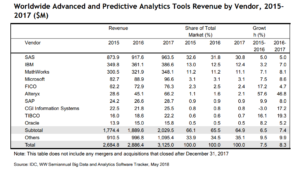

According to the latest IDC report, SAS owns nearly 31% of the market share for the advanced and predictive analytics software category, about twice its nearest competitor. SAS has been so dominant in the data analytics business for so long that making a dramatic change in business strategy would almost certainly hurt revenues. SAS’s software has been deployed at 83,000 business, government and university sites across 147 countries, which is a legacy to be proud of – and to protect.

However, much of the AI research being conducted involves open source tools, and many AI applications are being implemented in Python, as well as R, both which are open source languages that compete directly with SAS’s proprietary language. It seems clear that SAS will never open source its core analytics language and environment, simply because it doesn’t have to.

Many startups release their analytics software as open source to help build market share and foster name recognition, but SAS has already achieved that success — and more — with a proprietary model.

But that raises the question: How can SAS compete in an analytics and AI world that’s increasingly dominated by open source?

Competing with Open Source

SAS executives provided Datanami with good responses to that question. For starters, SAS product managers are not shy about incorporating open source software into their products if they think they can make them better, which is an arrangement that’s possible thanks to lenient open source licenses.

“There’s great opportunity to look at things that we’ve done in the past and re-evaluate if a learning system can replace it,” Schabenberger said. “And maybe that system might actually be … less biased or less unfair than the one we put together ourselves, but that needs to be proved.”

SAS has already incorporated open source neural networking technology into its products, particularly around natural language processing and computer vision algorithms, and it figures to widen that open source adoption as the technology improves.

“We’re not closing the doors and windows and saying ‘We’re not going to look at what’s going on in the market,'” says Randy Guard, SAS’s chief marketing officer. “It’s a different world than saying it’s binary, it’s either SAS or open source.”

SAS started integrating with open source analytics several years ago, and earlier this year shipped a new version of its Viya platform that opened the door to SAS customers incorporating a variety of open source libraries, including Python packages and Scikit-learn. You can expect that trend to continue as the analytics ecosystem continues to grow, with open source projects (mostly Python) driving a lot of that growth.

“In the minds of people right now, there’s a lot of use of open source analytics, and we get that, Our clients have it, so we’re not going in saying you have to get rid of all that, ” Guard said. “But they’re seeing where it’s almost the abundance theory – three or four things put together actually solves the business problem…. We believe in a lot of case these are ensembles of models. You can have three models, two from SAS and one that’s open source, and get to the answer you want.”

Focus on Deployment

SAS has a very diverse series of software products and services. It develops and sells core technologies and tools that allow data scientists, analysts, and engineers to create analytic applications using machine learning, statistical inference, and other techniques, but it also sells complete analytic solution for risk management, fraud detection, and campaign management. That’s unique and gives it certain advantages.

SAS spent 26% of its 2017 revenues of $3.24 billion on research and development, which came to more than $840 million. That is much higher than the industry average, and a portion of that is going into creating better algorithms. The company definitely wants to compete on algorithms, but a quicker way into its customers’ budgets could come from providing tools to help customers wrangle models developed with open source libraries into production, which executives says remains a weakness in the open source boat.

“We do a lot of work in algorithms, and we do innovation there, but this whole breadth of this platform is a focus for us,” Guard said. “We’ll do both. We’ll do the discovery side….and the deployment side.”

SAS’s core value proposition is providing enterprises with a centralized place to do their data analytics, and providing a standardized workbench where all interested parties can access the same environment in a reliable and governed manner, Schabenberger said.

“So whether you want to try a deep learning model, a neural network model, from R or from Python or from SAS, it’s the same code that’s being executed, it’s the same model that’s being trained, it’s the same parameter values that are being determined on the same data, and that is a very important value proposition for our customers,” Schabenberger said. “After all, most of our revenue comes from enterprise-class customers.”

AI in SAS’s Wheelhouse

Schabenberger admits that progress in deep learning has progressed faster than he anticipated. And in some use cases, such as creating customer segments in a marketing campaign, deep learning technologies and techniques have exceeded the time-tested rules-based capabilities that made SAS the dominant leader in analytics for so long.

But SAS is taking a pragmatic approach to AI. It’s content to leverage AI as an enabling technology where it makes sense, and keep evaluating it where it’s enterprise use cases are still emerging (such as in NLP). All in all, SAS is adamant about not viewing AI as competing path to SAS, but rather just one more path that can help customers achieve analytics nirvana.

“I don’t see a clear separation between what we’re doing in AI today and analytics,” Schabenberger said. “At SAS we see this a continuation of analytics rather than AI as a separate thing….For us, we think this is right in our ballpark, right in our wheel house.”

Related Items:

SAS Previews Upcoming Enhancements to Viya Platform

SAS Goes Back to the Future of Cognitive Computing with Viya