Teradata Turns 40, Takes Off Gloves, Readies for a Fight

(Photo courtesy Teradata)

The past, present, and future of Teradata collided yesterday at the company’s headquarters in San Diego, California, where 1,500 employees and guests – including four of the company’s original founders — gathered to celebrate the company’s improbable 40-year run. And facing tough competition in the analytics ring, Teradata’s CEO vows to go on the offensive.

The odds were stacked against Teradata from the very beginning, when a group of computer scientists gathered in Jack Shemer’s garage in Brentwood, California. It was the summer of 1979, and the future was not what you would call bright.

“All I remember is interest rates were astronomically high,” said Jerry Modes, one of Teradata’s co-founders, in a video that played on a large outdoor screen. “Carter was president….We decided to start a company right in the worst time there was.”

“Between Labor Day and Thanksgiving, the price of gold went from $350 to $850 dollars an ounce,” said Phillip Naches, another co-founder, in the video (which you can view here). “The prime rate went from 8% to 22%, and we knew that there was a big recession was coming on.”

“It was not an environment conducive to being a startup,” Shemer said in the video. “Being a startup, you know you’re going to live or you’re going to die. You don’t want to fall on your sword or fall on your six shooter. You want to make sure you take a rifle shot and succeed.”

The founders were all technically adept, but they relied on Shemer, Teradata’s original CEO, to shake some money loose from the venture capitalists, which was not an easy task given the economy at the time.

“He could charm the birds out of the trees,” Teradata co-founder David Hartke said in the video. “He went around to many investors and talked them into investing with Teradata.”

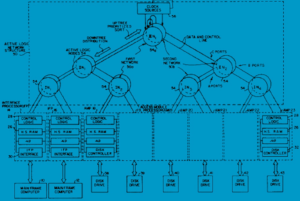

The fledgling firm succeeded in being awarded a patent for a key piece of technology: the YNET, which was a network interconnect that allowed the company to parallelize the database workloads.

“The YNET gave us the ability to process the workloads incrementally,” Shemer said in the video. “We could build a 50 processor machine and then we could double that very easily to handle a much bigger workload. So incrementally you could increase the capacity of the system and that attracted a lot of user to do things they hadn’t done before.”

Shemer, Naches, Modes, and Hartke were all on stage at Teradata’s 40th birthday bash yesterday, which featured food, drink, live music from local band Three Doors Down, and even fireworks (not an easy permit to get in fire-wary San Diego). The founders are revered by employees of Teradata, some of whom have been with the company for upwards of four decades. (At the event, the comapny highlighted “Teradata classics,” but none of them have been with the company all 40 years. Anybody with 40 years of tenure started with NCR or AT&T, Teradata confirmed.)

Teradata is one of the most successful analytics firms of all times. The company, which has had two IPOs and been subsidiaries of NCR and AT&T, today employs 11,000 people around the world and enjoys about $2.3 billion in revenue. But that success was never a guarantee.

“It was not an overnight success for Teradata,” Shemer said on the stage yesterday. “We had to keep working. And you folks are carrying on that torch and working forward. I have no doubt that you folks …will make Teradata itself more than it is today. Thank you so much for your…tenacity.”

The company has just emerged from one of the most difficult periods in its history, during which time the company made a poor strategic decision. According to Oliver Ratzesberger, who was appointed CEO in January, the leadership team in place before 2012 put too much emphasis on maintaining Teradata’s hardware business.

Teradata founders at the company’s 40th birthday celebration in San Diego on June 13, 2019 (Photo courtesy Teradata)

“The prior leadership of the company did not really engage in thinking through where to take that technology,” Ratzesberger told Datanami in an interview yesterday. “They were very set on ‘We have this hardware, it’s called a data warehouse appliance and the world just must love this data warehouse appliance.’

“And the world did so until 2012,” he continued, “at which point in time, people are saying, ‘Appliances are so yesterday. I want open standards. I want cloud. I want an ecosystem.’ And these clouds started taking off. And Teradata missed the boat a little bit on that. They said, ‘No, no, no, customers will come back. They will buy our appliances.”

Teradata has been transitioning away from the dedicated appliance model since 2012, when Ratzesberger joined the company and took over engineering. Ratzesberger oversaw the breakup of hardware and software, and the launch of software-only and cloud offerings. The transition was not easy, however, and the board brought in new leadership in 2016 with the appointment of Vic Lund, who was supposed to oversee the transition over a period of six months. Instead, Lund spent three years as Teradata’s CEO, stepping aside for Ratzesberger’s ascension in January.

Under the leadership of Lund and Ratzesberger, Teradata achieved something remarkable: It not only weened most customers off the dedicated Teradata hardware, moving customers to the software equivalents of the hardware-based YNET and BYNET. But it also made huge progress in moving away from the perpetual licensing model and toward a subscription-based one.

Teradata started 2018 with about one-third of its revenues coming from subscriptions. Its leaders thought that if it could get that number up to two-thirds of revenue by the end of the year, it would be a success. Instead, by the fourth quarter, the company succeeded in getting 84% of its revenue from subscriptions.

Lund, who is now executive chairman, boisterously celebrated that turnaround with his employees and guests yesterday. “I’ve been debating. It’s hard to figure out if I’m going to be the good boy or the real boy,” he told the audience. “The real boy. Teradata is f*****g back!”

The company now has the sort of annual recurring revenue (ARR) figures that Wall Street likes to see in a software company. But where does the company go from here from a product point of view? Ratzesberger provided some clues.

“We launched in October Vantage, our analytics platform,” he said in an interview. “We also combined the traditional SQL engine with other assets – some we had ourselves, like Vantage, and a lot of open source assets out there, languages like Python and R, to not only show up with a very high performance capable database, but to show up with an analytics ecosystem that out of the box can do things that normal databases can’t do: path analytics, graph analytics, machine learning.”

The feedback on Vantage has been good, he said. Teradata’s software is now available in two clouds, AWS and Azure, which makes customers happy and also generates the ARR figures that shareholders want to see. But customers want something more than just software available in the cloud, Raztesberger said.

“The other thing we’re hearing from customers is they love Vantage and love Teradata Everywhere. But buying hardware or even software or doing it ourselves in the cloud? Eh,” he said. “Actually, what would be much more interesting is you deliver it as a service.”

Teradata is offering its full suite of software as a fully managed cloud service that takes the hard work off the customers’ hands. “You can start it and stop it, grow it or shrink it but we do it all for you behind the scenes,” Ratzesberger says. “You don’t need to have the technology expertise. You don’t need to know how to install it, how to upgrade the software or to keep it secure, how to manage the SLAs. We do that for you. You point data at it and you ask the question that you have.”

The next phase of Teradata’s plan is to deliver one more level of abstraction. “If you look forward to where we’re headed is not just Vantage as a service but business outcomes as service,” he said. The company has already worked with an oil services company to automate the delivery of analytic insights in a way that lets they say “Here’s a 3% optimization opportunity for you if you change the behavior of the oil production,” Ratzesberger says.

Under Ratzesberger, Teradata has a new swagger. The Austrian-born and Harvard-educated technologist says the company will no longer take potshots from competitors sitting down. The company is adamant about its commitment to family, but it’s no longer Mr. Nice Guy.

“Part of why we have rebranded the company also is to make a little bit of a statement there’s a new company in town,” he said. “The old Teradata was a very passive company. The old Teradata would take punches from competitors year in and year out because they were always playing the gentleman, saying ‘Well eventually our technology will prevail.’

“Those days are gone,” he continued. “We are going on the offensive.”

The first target: Snowflake.

Related Items:

Inside Teradata’s Audacious Plan to Consolidate Analytics

New Teradata Focuses on Answers, Not Analytics

Teradata Climbs Up the Stack with ‘Analytics Platform’ Strategy

Editor’s note: This story was updated to reflect the fact that no Teradata employees have been with the company continuously for 40 years.