CDOs Must Shift to Offense, Survey Finds

(Olivier Le Moal/Shutterstock)

The financial services sector faces among the toughest data compliance and risk management challenges, some of which are being addressed by AI-based analytical cloud services. But a vendor-sponsored survey of chief data officers (CDOs) finds that a majority of those data management tasks remain manual processes.

The study concludes the sector must shift from defense to offense.

The survey of 100 data chiefs revealed an unsettled compliance and risk landscape, with a vast majority of CDOs saying those data management tasks are being automated. Still, automated compliance initiatives consume at least 40 percent of data practice budgets, forcing managers to retain many manual data management functions.

Those and other data challenges are hindering financial sector efforts to transition from “defensive” data management steps like data security and governance to “offensive data management,” according to survey sponsor InterSystems, the cloud-based data management specialist. “The research shows that there is still more work required on defensive data management and automating compliance functions,” said Ann Kuelzow, global head of financial services at InterSystems, Cambridge, Mass.

InterSystems and other vendors are using machine learning and other AI frameworks to help financial services firms improve data compliance while reducing risk. Those frameworks address the current lack of downstream visibility into how sensitive data is being used.

Emerging fintech approaches aimed at unifying diverse data sets seek to attach a “risk descriptions” that address downstream data usage.

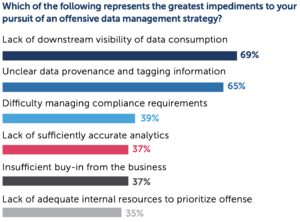

Those techniques could replace information tagging and other data provenance steps that were cited by about two-thirds of respondents as an impediment to downstream visibility into data consumption.

Source: InterSystems

Indeed, 70 percent of CDOs surveyed said risk data aggregation was their top regulatory concern, while a slightly lower percentage said they are using data lineage as a governance tool.

Along data lineage, other emerging automation fintech approaches include AI-based data fabrics and meshes, machine learning models and blockchain tools.

Sixty-three percent of CDOs said they expect to develop analytics platforms as part of their proactive data management initiatives.

“Financial organizations have reached a significant level of maturity when it comes to data compliance, allowing them to pursue an offensive data management strategy,” the survey concludes. AI- and cloud-based services are seen as the best way to mitigate risk, including improved downstream visibility and determining data provenance.

Respondents to the CDO survey were divided equally among asset managers, hedge funds, insurers and investment banks. Nearly all led their firm’s data and analytics efforts. The survey conducted by WBR Insights is here.

Recent items:

Goldman Releases Data Modeling Tool